What is the relationship between CBAM and the European Union Emissions Trading System (EU ETS)?

The European Union Emissions Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM) are primary policy tools for the EU’s response to climate change. While closely related, each has distinct focuses and purposes. The EU ETS, initiated in 2005, has been a core mechanism for reducing greenhouse gas emissions in the industrial and power sectors. Simultaneously, CBAM serves as a supplementary measure to ensure that imported products are also subject to an equivalent carbon price.

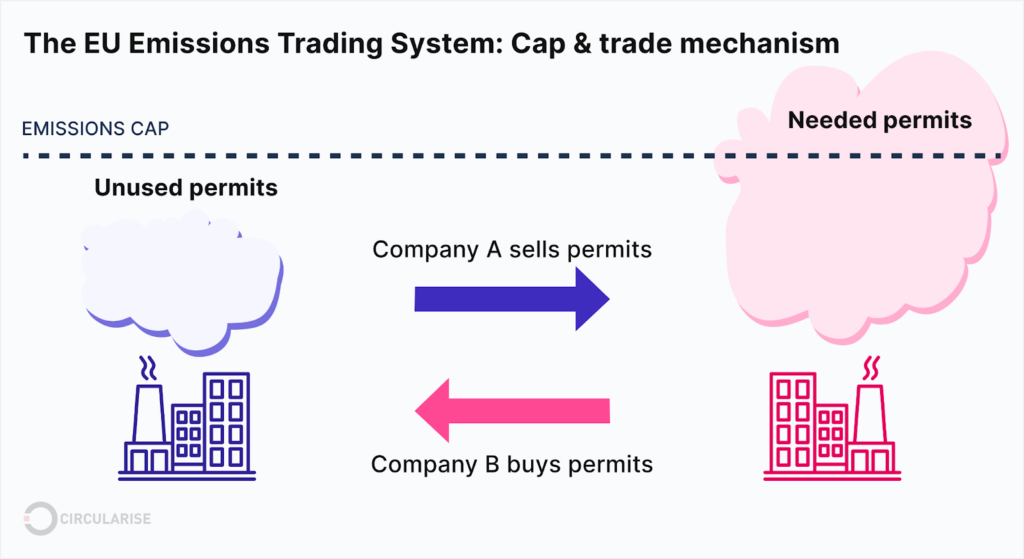

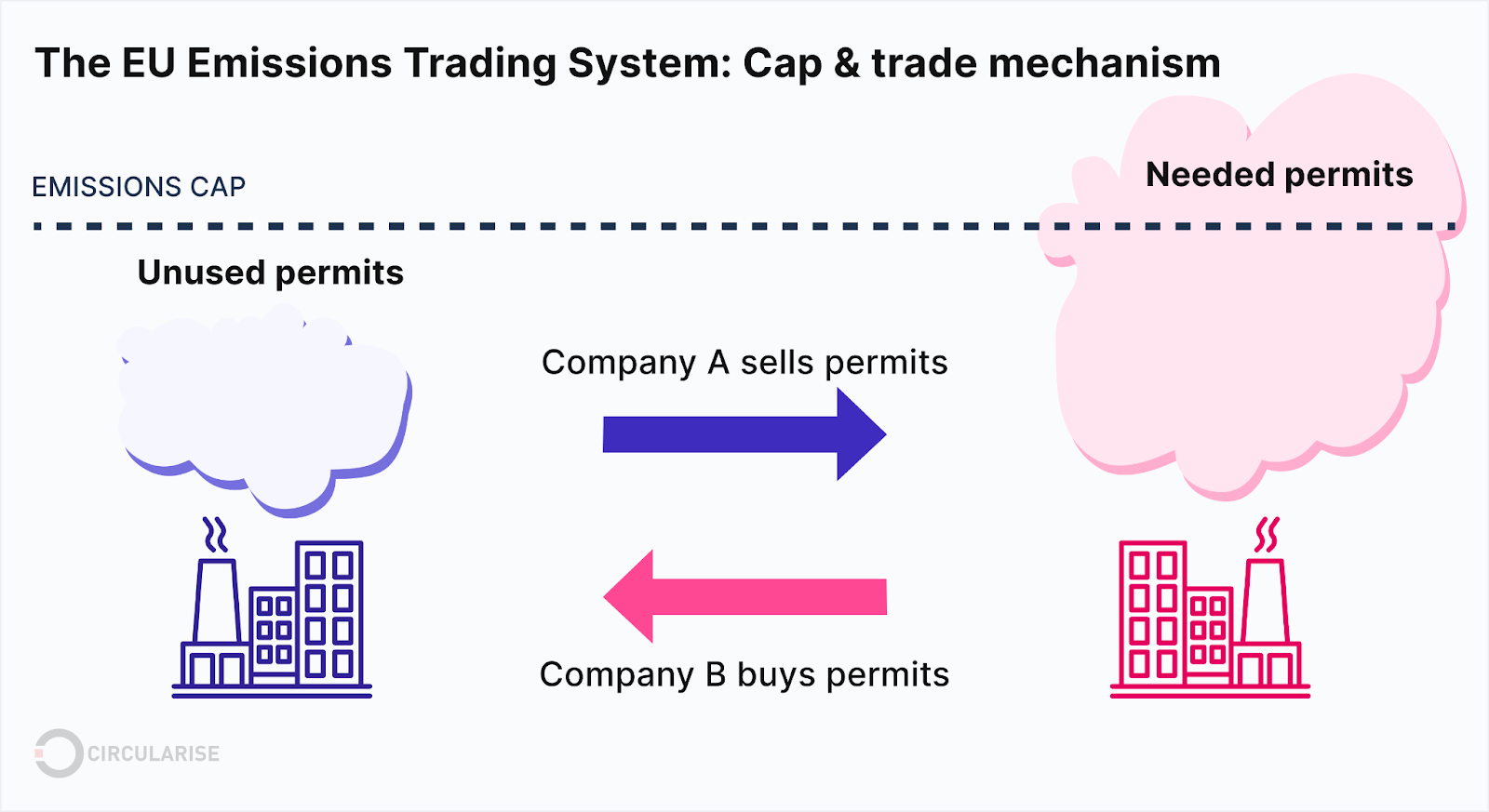

First, let’s delve into the operation of the EU ETS. Based on the concept of “cap and trade,” the EU ETS sets a total emission limit for specific periods, dividing these emission allowances into tradable units. This establishes the world’s first large-scale regional and transnational emissions trading scheme. Companies participating in the scheme must possess sufficient allowances to cover their actual emissions while having the flexibility to buy and sell allowances in the market. This design incentivizes companies to upgrade technologies, reduce emissions, and contribute to the EU’s climate goals.

Against this backdrop, the Carbon Border Adjustment Mechanism (CBAM) emerged to address the issue of carbon leakage. Carbon leakage occurs when companies relocate production to regions with less stringent emission regulations to avoid more stringent requirements, posing a threat to global emission reduction goals. To prevent this, the EU introduced the Carbon Border Adjustment Mechanism, aiming to ensure that products imported into the EU are subject to a similar carbon price, thereby reducing the incentive for manufacturers to shift production locations to evade emission regulations.

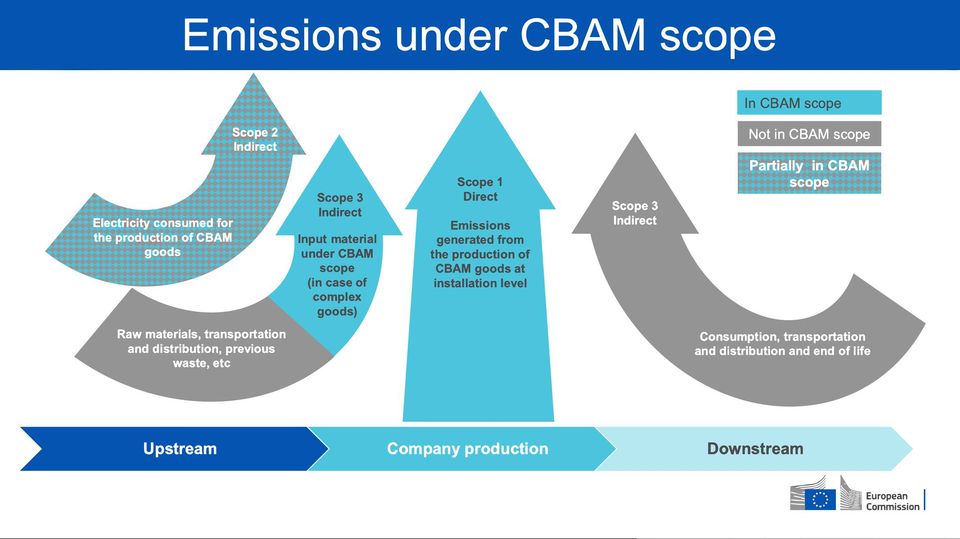

The implementation of CBAM is closely tied to the EU ETS. CBAM is based on the embedded emissions in imported products, meaning importers must pay a designated carbon price associated with the EU ETS. However, CBAM differs from the EU ETS in that it is not a “cap and trade” system and allows companies to purchase an unlimited number of certificates, unlike the fixed quotas in the ETS.

In practical terms, there is a dynamic interaction between CBAM and the EU ETS. When CBAM is fully implemented in 2026, it will be adjusted based on modifications to the EU ETS, especially concerning the reduction of free allowances available in the industries covered by CBAM. This interaction ensures coordination between the two, ensuring that global producers play an active role in reducing greenhouse gas emissions.

In conclusion, the EU ETS and CBAM are crucial tools for the EU’s response to climate change, collectively driving the EU toward ambitious emission reduction goals. The EU ETS, through emissions trading within its internal market, stimulates internal motivation within companies, while CBAM, through a carbon pricing mechanism, expands the scope of climate policy, ensuring fair competition conditions for imported products. The synergistic effect of these measures promotes climate-friendly production and business practices globally, providing robust support for global climate action.