How Industries Affected by CBAM Should Respond

The implementation of the Carbon Border Adjustment Mechanism (CBAM) by the European Union has ushered in a new era for industries, with a particular focus on steel, cement, aluminum, fertilizers, hydrogen, and electricity. As companies grapple with this transformative shift, strategic responses are crucial for ensuring competitiveness and compliance.

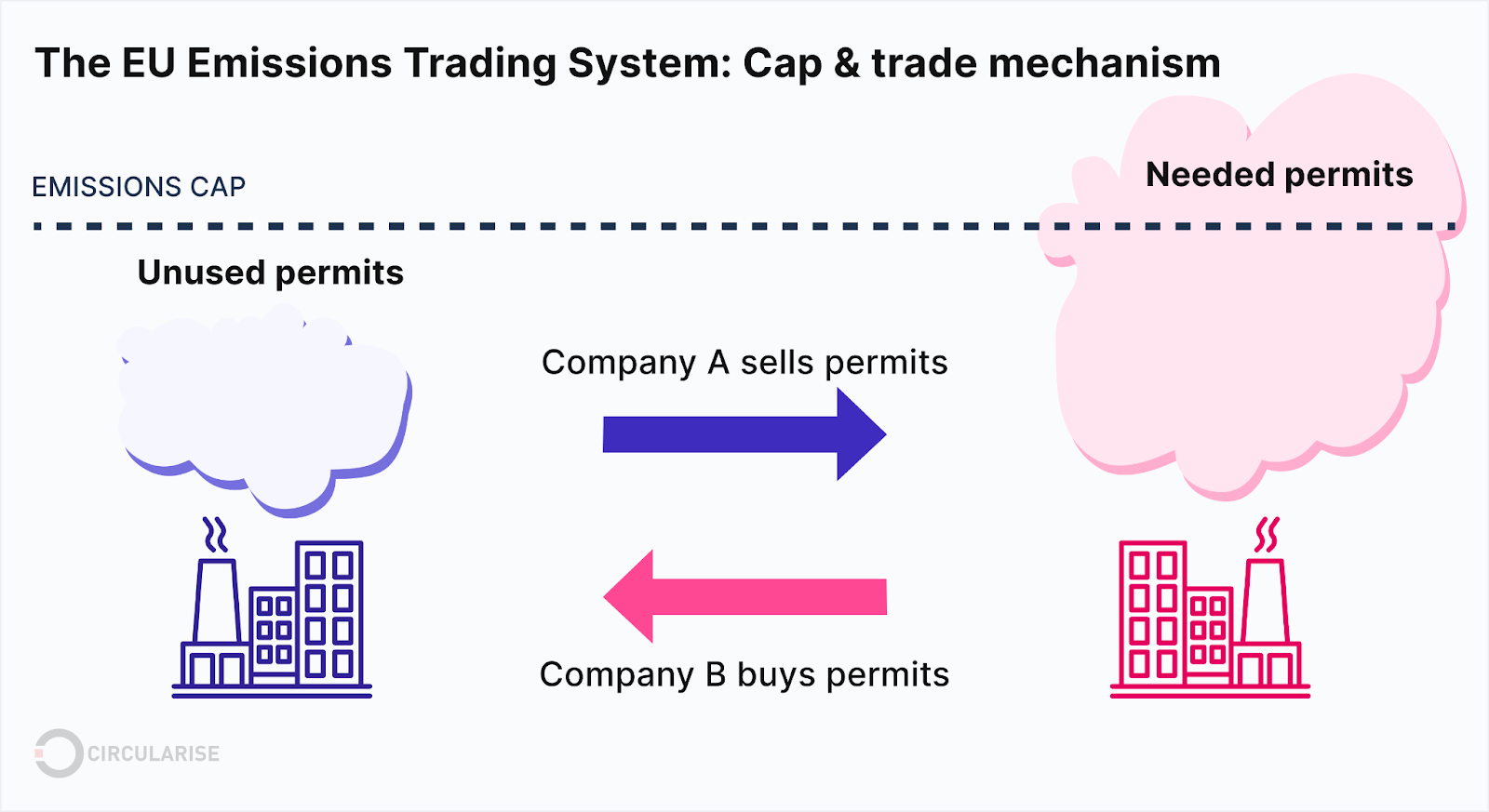

Understanding the CBAM Landscape: CBAM, deeply linked with the European Union Emission Trading Scheme (EU ETS), primarily impacts industries already regulated under EU ETS guidelines. This includes sectors like steel, cement, aluminum, fertilizers, hydrogen, and electricity. The choice of these industries for initial inclusion in CBAM stems from their coverage under EU ETS.

Most-Favored Nation Treatment: Guided by the foundational principle of the General Agreement on Tariffs and Trade (GATT) – the Most-Favored Nation (MFN) treatment – CBAM mandates equal treatment for all member countries. Thus, industries not subject to EU ETS regulations won’t fall under CBAM when exporting to the EU.

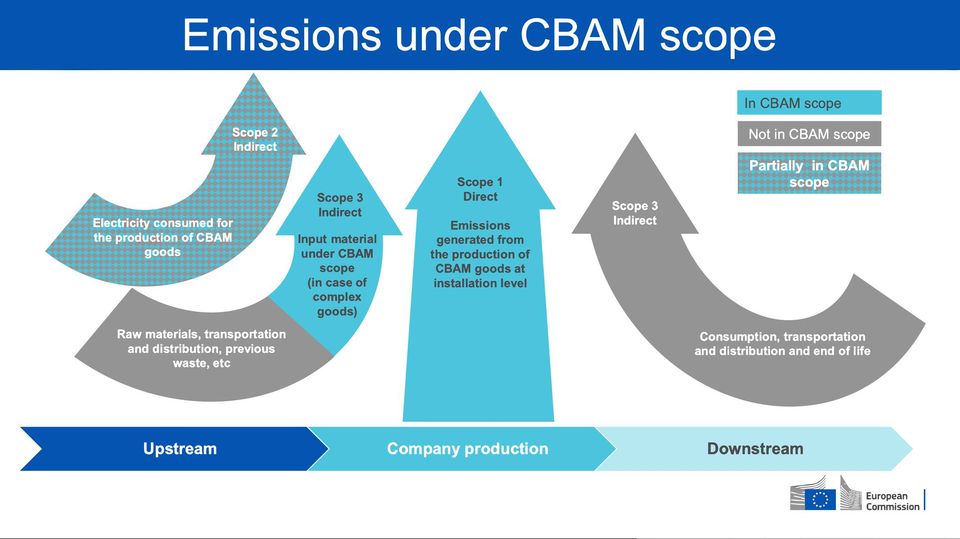

Strategies for Compliance: Companies within the affected sectors must develop strategies to navigate CBAM effectively. Compliance involves understanding and calculating embedded emissions, covering both direct and indirect emissions throughout the production process. It’s essential to recognize the interconnectedness of CBAM with ISO 14064-1, as organizations will need to undergo greenhouse gas inventories following the ISO standards.

Roles and Responsibilities: Various entities play roles in CBAM compliance, from manufacturers calculating embedded emissions to importers reporting the data to the EU. Importantly, precursor manufacturers supplying raw materials and downstream subcontractors handling specific processes must also provide accurate emission data. The failure of any entity within the supply chain to comply can affect the overall ability to export to the EU.

Financial Implications: While importers bear the responsibility for CBAM reporting and tax obligations, manufacturers’ ability to provide accurate embedded emission data directly impacts competitiveness. Higher embedded emissions translate to lower price competitiveness, potentially affecting market share.

Looking Ahead: As CBAM unfolds, further details on implementation, reporting mechanisms, and potential amendments will emerge. Staying informed and adapting strategies in response to evolving regulations will be paramount.

In conclusion, responding effectively to CBAM implementation requires a comprehensive understanding of its nuances, collaboration across the supply chain, and proactive measures to ensure compliance. This article aims to provide valuable insights for industries navigating the complexities of CBAM, offering guidance on strategies and considerations for a seamless transition. For more detailed inquiries or assistance tailored to your specific needs, please feel free to reach out through the provided contact channels.