Who will be affected by CBAM?

After the implementation of CBAM, besides the European Commission responsible for formulating regulations and the EU member states responsible for enforcement, there are four categories of stakeholders who will be affected by CBAM:

EU Importers

Importers are obligated to declare CBAM reports and serve as the entities responsible for carbon tax payment after the official start of CBAM (January 1, 2026). Similar to import tariffs, importers are the taxpayers, not the manufacturers or export traders.

CBAM Product Manufacturers

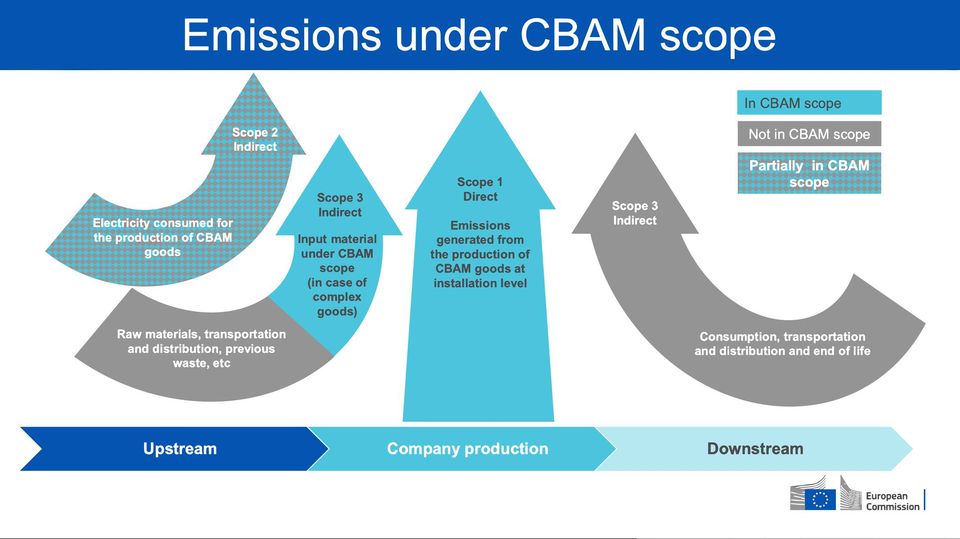

CBAM goods refer to product categories that have been brought under CBAM regulation, such as screws. Manufacturers are required to calculate the “embedded emissions” of CBAM goods and provide relevant data to EU importers for declaration. Although manufacturers are not the taxpayers for CBAM carbon taxes, a higher level of embedded emissions indicates lower price competitiveness for the goods.

If a manufacturer fails to deliver CBAM declaration data on time, what impact will it have? The EU’s regulatory target is EU importers. When importers cannot obtain relevant CBAM declaration data, they may face fines. This implies that manufacturers unable to provide CBAM declaration data may lose orders.

Precursor Manufacturers

The term “precursor” refers to the raw materials that manufacturers purchase, for example, the steel coils used to produce screws. In this case, the precursor manufacturer must also provide embedded emissions data for the precursor to the manufacturer producing CBAM goods. In other words, even if the precursor manufacturer does not export goods to the EU, they will still be affected by CBAM. They must learn how to calculate the embedded emissions of precursors, or they may risk losing orders.

Downstream Contract Manufacturers of CBAM Goods

CBAM commodity manufacturers may outsource certain processes to other entities, such as electroplating, heat treatment, and other processes. The calculation of CBAM embedded emissions includes both raw materials (precursors) and the entire manufacturing process. This implies that professional subcontractors must also learn how to calculate embedded emissions to continue receiving orders.

Although CBAM reporting is the responsibility of EU importers, the actual data providers include CBAM commodity manufacturers, upstream raw material suppliers, and downstream professional subcontractors. If any role in the supply chain fails to provide accurate emission data, it will adversely affect orders destined for export to the EU.

相關文章:

How Industries Affected by CBAM Should Respond

How Industries Affected by CBAM Should Respond

Which embedded emissions need to be reported by each CBAM sector?

Which embedded emissions need to be reported by each CBAM sector?

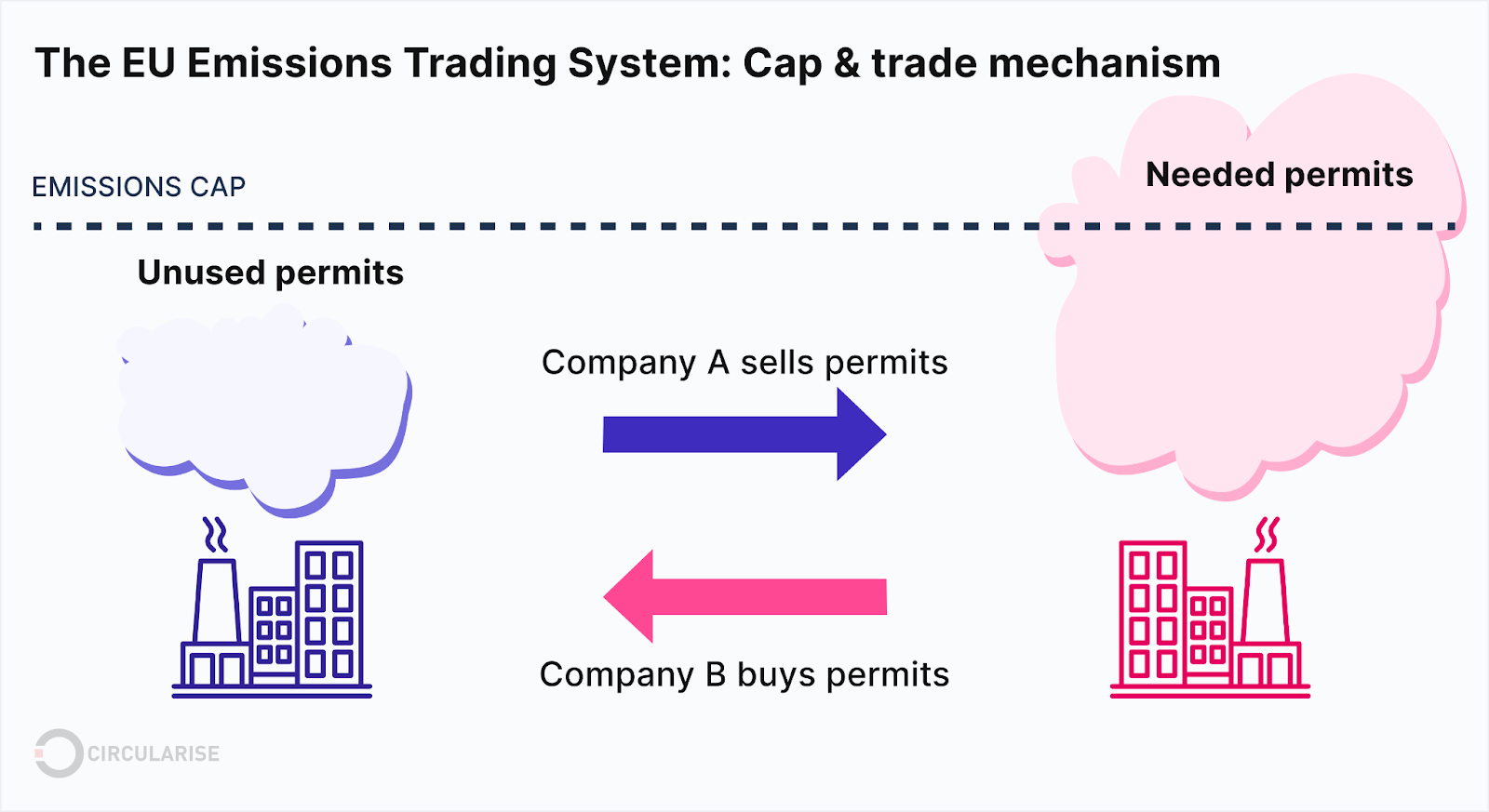

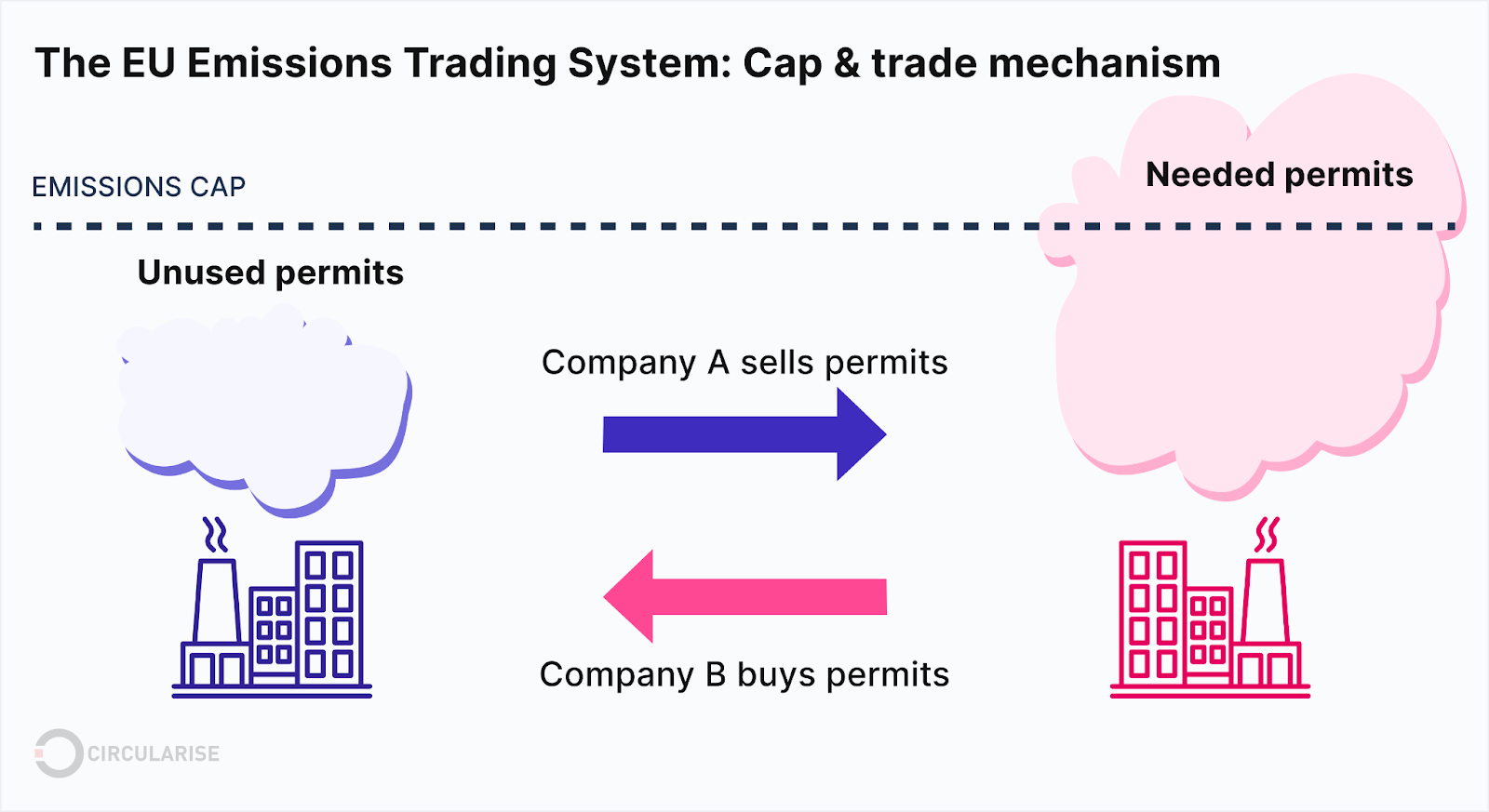

What is the relationship between CBAM and the European Union Emissions Trading System (EU ETS)?

What is the relationship between CBAM and the European Union Emissions Trading System (EU ETS)?

What are embedded emissions? How do they differ from carbon footprints?

What are embedded emissions? How do they differ from carbon footprints?

CBAM 與歐盟排放交易體系 (EU ETS) 有什麼關聯呢?

CBAM 與歐盟排放交易體系 (EU ETS) 有什麼關聯呢?