Which embedded emissions need to be reported by each CBAM sector?

CBAM currently covers six major industry sectors: cement, fertilizers, steel, aluminum, hydrogen, and electricity. There are slight variations among these sectors regarding the types of greenhouse gases to be reported, and whether the reporting includes direct and/or indirect emissions.

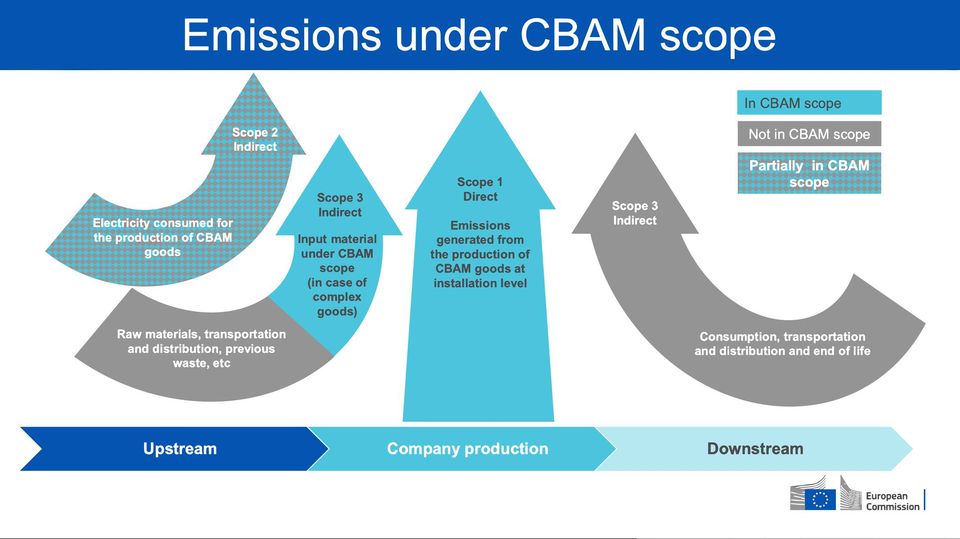

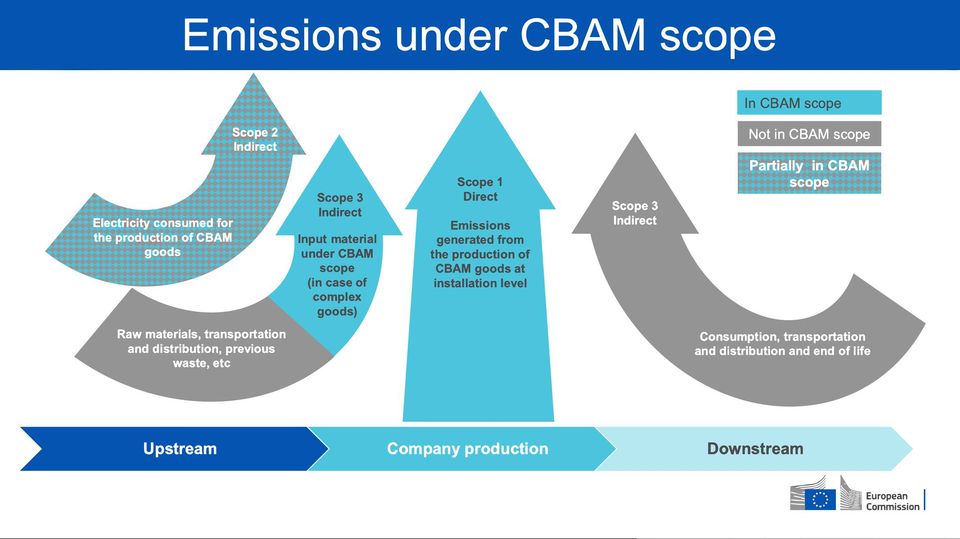

The table below provides an overview of specific emissions and greenhouse gases, along with how direct and indirect emissions are determined within each industry sector under the EU CBAM scope. The EU has taken into account the specific circumstances of each sector when designing the reporting and calculation methods for embedded emissions in these goods, reflecting the EU emissions trading system.

| Issue | CBAM good | |||||

|---|---|---|---|---|---|---|

| Cement | Fertilisers | Iron/Steel | Aluminium | Hydrogen | Electricity | |

| Reporting metrics | (per) Tonne of good | (per) MWh | ||||

| Greenhouse gases covered | Only CO2 | CO2 (plus nitrous oxide for some fertiliser goods) |

Only CO2 | CO2 (plus perfluorocar bons (PFCs) for some aluminium goods) |

Only CO2 | Only CO2 |

| Emission coverage during transitional period | Direct and indirect | Only direct | ||||

| Emission coverage during definitive period | Direct and indirect | Only direct, subject to review | Only direct | |||

| Determination of direct embedded emissions | Based on actual emissions, but estimations (including default values) can be used for up to 100% of the specific direct embedded emissions for imports until 30 June 2024 (i.e. CBAM reports due until 31 July 2024) and for up to 20% of the total specific embedded emissions for imports until 31 December 2025 | Based on default values, unless several cumulative conditions are met | ||||

| Determination of indirect embedded emissions | Based on actual electricity consumption and default emission factors for electricity, unless conditions are met (i.e. direct technical connection or power purchase agreement). Estimations (including default values) can be used for up to 100% of the specific indirect embedded emissions for imports until 30 June | Not applicable | ||||

相關文章:

What are embedded emissions? How do they differ from carbon footprints?

What are embedded emissions? How do they differ from carbon footprints?

什麼是CBAM產品碳含量(embedded emissions)?與碳足跡有什麼不一樣?

什麼是CBAM產品碳含量(embedded emissions)?與碳足跡有什麼不一樣?

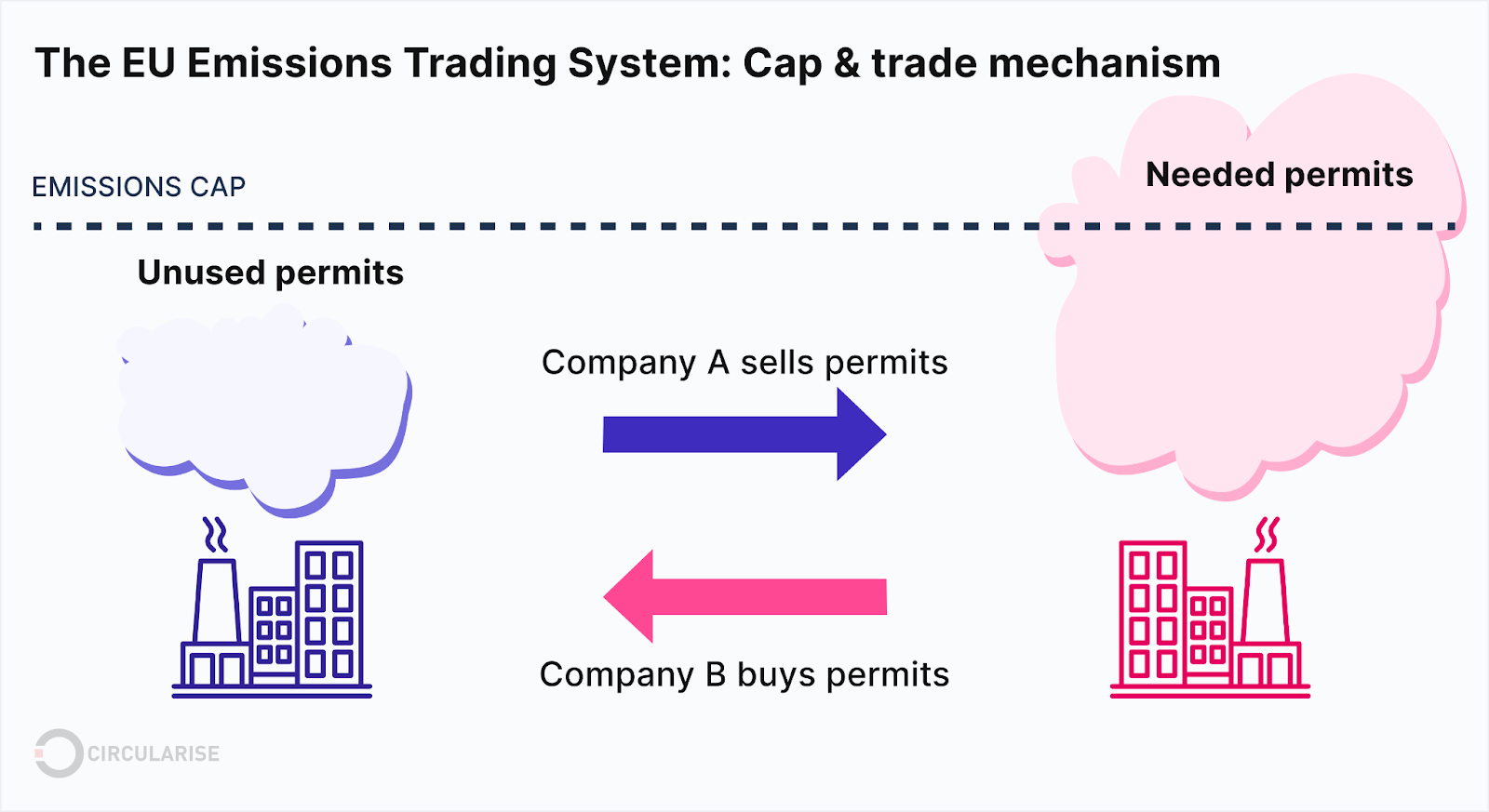

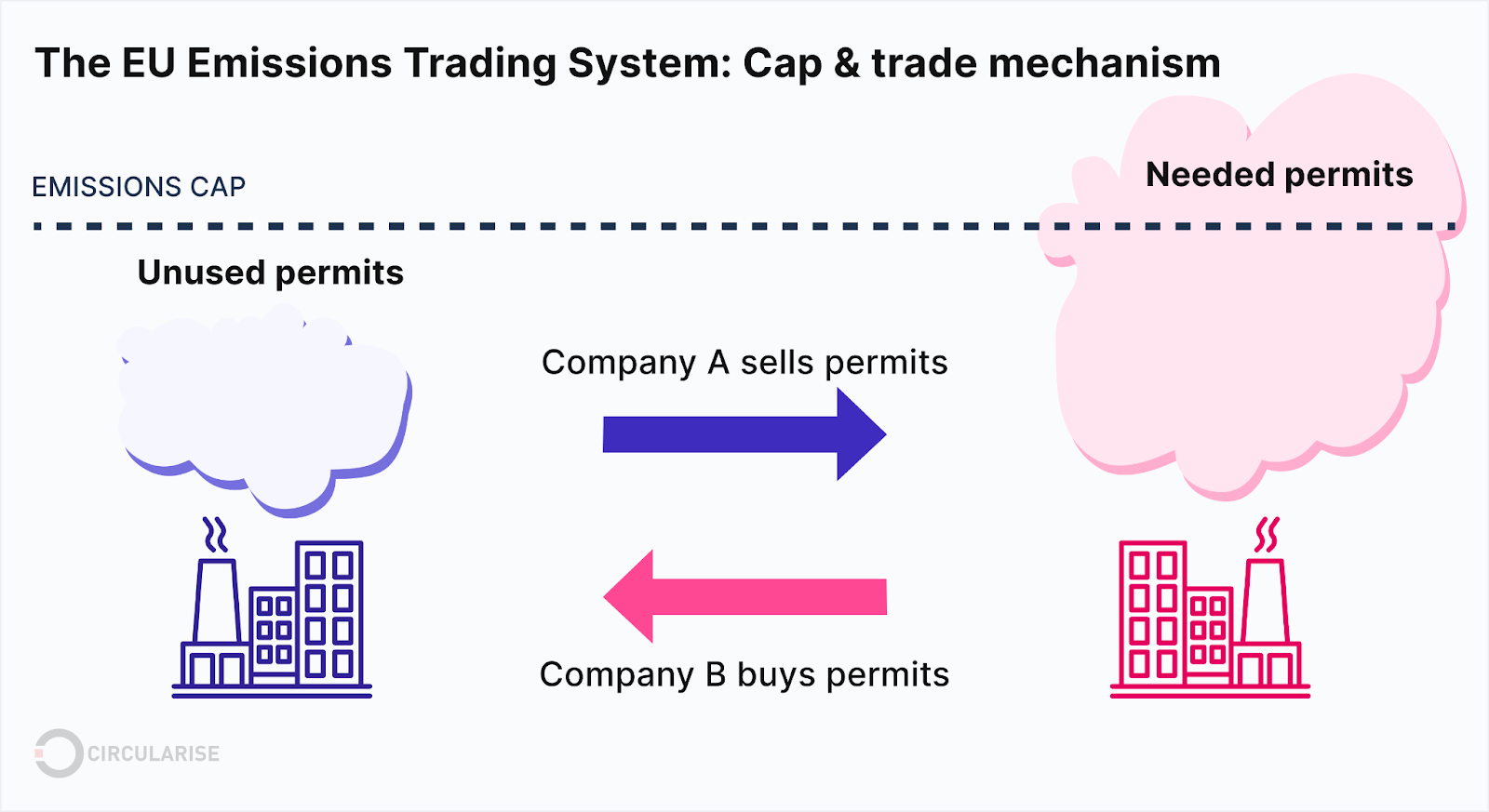

What is the relationship between CBAM and the European Union Emissions Trading System (EU ETS)?

What is the relationship between CBAM and the European Union Emissions Trading System (EU ETS)?

Who will be affected by CBAM?

Who will be affected by CBAM?

How Industries Affected by CBAM Should Respond

How Industries Affected by CBAM Should Respond

CBAM 與歐盟排放交易體系 (EU ETS) 有什麼關聯呢?

CBAM 與歐盟排放交易體系 (EU ETS) 有什麼關聯呢?